Investing in Russia

Great Article by Matt Marshal at VentureBeat.com

Great Article by Matt Marshal at VentureBeat.com

Russia is the sixth-largest economy in the world, but it’s also a country relatively untouched by foreign investors, especially investors in technology. Could Russia potentially be the home of the next massive tech boom?

The short answer is: No way. At least not anytime soon. That’s the conclusion I’ve come to after a week in Moscow, a week in which I took part in the first ever delegation of US venture capital investors to visit Russia.

The organizers invited me as the sole member of the U.S. media. (Disclosure: My trip was organized by AmBar, a group of U.S.-based Russian professionals, and paid for by Rusnano, a government investment fund. In return, I promised to write an honest account of what I found.)

Russia is making huge efforts to change. It is plowing billions of dollars into the planned high-tech city of Skolkovo over the next couple of years that it hopes will replicate Silicon Valley. Through $5 billion in other investments, it also plans to produce a $30 billion nanotechnology industry by 2015. Russian leaders, led by President Dmitry Medvedev, have convinced me they want to clean up corruption and that the only way they can achieve sustained economic growth is to diversify, and that means supporting the tech industry. Russia is trying hard to reform and progress. My brief visit makes me think it will get there. Eventually.

But right now, Russia is still a mess. It is totally reliant on its oil wealth, and as prices for oil inch upward again, Russia may once more gain comfort and lose the urgency to change. It has a long way to go, and much of its plans are being implemented through Soviet-style top-down government mandates. The government needs to reduce its size drastically and let personal initiative take over. “It’s the people, stupid,” U.S. angel investor Esther Dyson, one of the earliest successful investors in Russia, said to me (see our video below).

Granted, the buzz is good

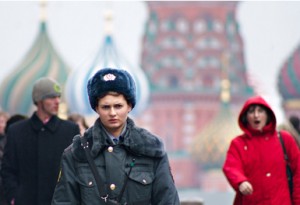

During our visit, we met with government officials, investors, parliamentarians, incubators and startups. I tagged along with 20 other investors. We also met several of the nation’s wealthiest tycoons, including the richest “oligarch,” Michael Prokhorov (pictured below right), who refused to do a video interview with me. Independently, I also organized a meetup of startups at the Ritz Hotel, just off Moscow’s Red Square. Some 45 entrepreneurs showed up. These guys are experimenting in all kinds of areas, but most of them are still focused on the Russian market. Still, there’s plenty of innovation evident here: Just a couple of examples: One company, Innosystems, has built a widget that lets you click a number to call online, with no software download. Another, QiwiPay, backed by Moscow-based venture capital firm DST, is building kiosks that let Russians pay their traffic violation fines automatically — so they can avoid waiting in line in court for a day, or worse, being shaken down by police soliciting bribes. I met others doing harder core stuff, such as Light Engines, which has a sophisticated lighting technology — although it is hardware, not the stuff Silicon Valley typically invests in.

During our visit, we met with government officials, investors, parliamentarians, incubators and startups. I tagged along with 20 other investors. We also met several of the nation’s wealthiest tycoons, including the richest “oligarch,” Michael Prokhorov (pictured below right), who refused to do a video interview with me. Independently, I also organized a meetup of startups at the Ritz Hotel, just off Moscow’s Red Square. Some 45 entrepreneurs showed up. These guys are experimenting in all kinds of areas, but most of them are still focused on the Russian market. Still, there’s plenty of innovation evident here: Just a couple of examples: One company, Innosystems, has built a widget that lets you click a number to call online, with no software download. Another, QiwiPay, backed by Moscow-based venture capital firm DST, is building kiosks that let Russians pay their traffic violation fines automatically — so they can avoid waiting in line in court for a day, or worse, being shaken down by police soliciting bribes. I met others doing harder core stuff, such as Light Engines, which has a sophisticated lighting technology — although it is hardware, not the stuff Silicon Valley typically invests in.

Now, of course, I’d be delighted if I could report that this Russia is the next India, China or Israel — all places that have seen massive foreign investment in recent years. Russia has among the highest per capita number of students in the world, boasts high levels of mathematics and science education, and being in desperate need of modernization, you’d think Russia would be a gold mine for investors. President Dmitry Medvedev greeted the delegation, and made clear that technology is needed to diversify from Russian oil, gas and metals — which make up 80 percent of Russia’s total exports. That legacy industry is highly influenced by a group of about 22 so-called oligarchs — many of them exerting their power behind the scenes through corruption. Technology entrepreneurship, if it is fostered, will lead to positive change — there is no question. Everyone agrees.

But investing in Russia can be “insanity”

The more time I spent in Russia, the more complex the story became (and I’m not the first to say that about Russia). The more I learned — about corruption, the abuses of the courts, the terribly archaic educational system, the choked up traffic, the lack of investment in infrastructure, the cultural penchant for Hobbesian brute leaders, the lack of a truly independent media, and the assassination of journalists when they do show independence — the harder it is for me see a positive short-term future for U.S.-style tech investment for this country.

If you’re considering investing in Russia, you may want to check out the history of Bill Browder (pictured left), the American investor whose firm, Hermitage Capital, emerged as the leading foreign investor in the 1990s and mid 2000s, with $4 billion under management. Hermitage documented corruption within some of the companies he invested in in Russia’s most tightly controlled oil and gas industries and exposed it to the media, and some of the oligarchs took umbrage. These were some of the biggest oil and gas companies in the world, including Gasprom. Beginning in 2006, his operations were expropriated by tax authorities operating with support from the Russian government, and he was declared a “risk to national security.” There’s eye-opening background in this two-part video series (Part I and Part II, and especially this longer video). His case is ongoing. Late last year, Browder’s attorney in Russia died after apparently being tortured while being held in jail by Russian authorities. Browder, who is in exile in London, has won a pledge from Russian President Dmitry Medvedev to launch a criminal investigation into the case. Any venture capital investment in Russia would amount to “complete insanity,” he said last week.

If you’re considering investing in Russia, you may want to check out the history of Bill Browder (pictured left), the American investor whose firm, Hermitage Capital, emerged as the leading foreign investor in the 1990s and mid 2000s, with $4 billion under management. Hermitage documented corruption within some of the companies he invested in in Russia’s most tightly controlled oil and gas industries and exposed it to the media, and some of the oligarchs took umbrage. These were some of the biggest oil and gas companies in the world, including Gasprom. Beginning in 2006, his operations were expropriated by tax authorities operating with support from the Russian government, and he was declared a “risk to national security.” There’s eye-opening background in this two-part video series (Part I and Part II, and especially this longer video). His case is ongoing. Late last year, Browder’s attorney in Russia died after apparently being tortured while being held in jail by Russian authorities. Browder, who is in exile in London, has won a pledge from Russian President Dmitry Medvedev to launch a criminal investigation into the case. Any venture capital investment in Russia would amount to “complete insanity,” he said last week.

His isn’t an isolated case. U.S. investors I’ve spoken, including Esther Dyson, have also heard of stories of “stripping” — that is, where private assets are stripped from their owner and reassigned to a government agency. However, most people I talked with suggested the practice is on the decline.

Yet Russia is a riddle, wrapped in a mystery….

Little is clear-cut in Russia. For every negative fact, there’s a positive one that provides balance. The trends are all very good. Compared to 10 years ago, criminality has declined significantly. It’s now safer to walk around for foreign investors. Peter Loukianoff, an investor with Almaz Capital Partners, one of the first Russian venture firms focused on IT, left the country in the mid-1990s, because of a rash of assassinations including foreigners, but he’s now back and doing business. True, corruption is still rampant: He knows of companies that get a call from the “fire department” demanding increases in “tax payments.” One company he knows of — a copier distributor — pays up to 40 percent of its profit toward this unofficial tax, he said. If you trade in physical goods, you’re more vulnerable, agrees Drew Guff, leader of one of the first private equity firms in Russia, who just announced an investment of $250 million to support Russia’s high-tech city project. It’s harder for Russian extortionists to track goods if you’re dealing in e-commerce.

Here’s a perverse logic in Russia I heard expressed by several people: “What’s wrong with an extra few points of corruption tax if your base income tax is only 13 percent?” It’s true that the taxes in Russia are relatively low, but that means the state, including the police offers and other government agencies, are constantly on the prowl for funds, and they use this to internally justify their thievery.

Ironically, though, there’s another Russian quirk that may help the likes of Hermitage find justice. Russia is one of the more bureaucratic countries in the world, with most transactions and legal actions filed at four different ministries. So remarkably, the details of the crackdown on Hermitage, documented in the scores of pleas made by Browder’s lawyer before he died in jail, are all safely recorded. It will be difficult for Russian leaders to erase evidence of what happened.

Privatization and reform will make it even harder for the thugs to rule. Yuri Soloviev, chief executive of VTB Capital, another VC firm in Russia supported in part by the Russian government, told us he once fought thugs from the fire department trying to tax his car business. But he says continued privatization — 2,000 government enterprises will be privatized over the next couple of years — will drive out corruption because it will give preying officials fewer places to hide. Reform has also led to higher levels of corporate governance, he said.

Privatization and reform will make it even harder for the thugs to rule. Yuri Soloviev, chief executive of VTB Capital, another VC firm in Russia supported in part by the Russian government, told us he once fought thugs from the fire department trying to tax his car business. But he says continued privatization — 2,000 government enterprises will be privatized over the next couple of years — will drive out corruption because it will give preying officials fewer places to hide. Reform has also led to higher levels of corporate governance, he said.

There are other signs of steady improvements. The problem is it’s all from a very low base level. Take education. Political officials constantly bribe teachers to get their kids into the best schools. Some 40 percent of university students say they face “regular” corruption, according to a survey cited by Sergey Guriev, rector of the New Economic School in Russia, in a talk with us. This, he said, has compromised the moral fiber of a whole generation of faculty and students. Quality of education in Russia’s strongest field, mathematics, is on the decline. However, the government, again backed by the reform-minded Medvedev (pictured left in the image above, with Putin), is pushing through standardized tests, and grading will be distributed regionally, which will help cut down on opportunities to bribe.

Medvedev, the prince of hope?

So who is this progressive leader, President Medvedev? No one knows how powerful he is, because he won elections only after Vladimir Putin termed out of the presidential spot. Putin had consolidated most of Russian power under his leadership and remains prime minister. Both men may run for president in 2012, which is when Russian watchers say the real test will come between the two men. Medvedev appeals to a more liberal demographic in Russia, while the thuggish Putin appeals to conservatives. Medvedev, a former law professor, is seen as a strong ally of the U.S. Next month, Medvedev will visit Silicon Valley to learn more about the tech region as he goes about helping guide more than $2 billion in investments into the scientific city called Skolkovo just outside Moscow. Medvedev has also complained about Russia’s lack of venture capital: The $2 billion managed by the nation’s 20 venture capital capital firms is “almost nothing,” he complains. He realizes the need for external VC investors, not merely for money, but for advice too.

Still, some question Medvedev’s fortitude in making change happen. For sure, there’s little sign he’ll be changing Russia’s top-down approach. One eye-opening example of Russia’s tendency to “plan” is the government’s investment of $5 billion in nanotechnology. The project drew skepticism from American investors during the visit last week, especially when it became clear that the Russian definition of “nano” is still murky. One joke is that entrepreneurs are throwing the word “nano” into their business plan and getting funding.

The Skolkovo project, however, is the most intriguing example (see good overview of the project here). Run by one of Russia’s oil oligarchs, Viktor Vekselberg (pictured left), reportedly a billionaire, the project entails building an “innovation city” from scratch and making it home to 20,000 people — complete with perimeter-wide security, clean-tech buildings, schools, healthcare and entertainment. He took questions — many of them skeptical — from members of the U.S. delegation. They told him it was “all about the people.” Innovation needs to bubble up, and government needs to get out of the way, the U.S. investors who were with me repeated over and over again. Vekselberg said he is negotiating letters of intent with Cisco and Nokia and is also talking with MIT, Siemens, Microsoft and Google to see if they too will agree to shift their R&D activities to the city. An extensive post-graduate institution and an incubator for startups are also planned.

The Skolkovo project, however, is the most intriguing example (see good overview of the project here). Run by one of Russia’s oil oligarchs, Viktor Vekselberg (pictured left), reportedly a billionaire, the project entails building an “innovation city” from scratch and making it home to 20,000 people — complete with perimeter-wide security, clean-tech buildings, schools, healthcare and entertainment. He took questions — many of them skeptical — from members of the U.S. delegation. They told him it was “all about the people.” Innovation needs to bubble up, and government needs to get out of the way, the U.S. investors who were with me repeated over and over again. Vekselberg said he is negotiating letters of intent with Cisco and Nokia and is also talking with MIT, Siemens, Microsoft and Google to see if they too will agree to shift their R&D activities to the city. An extensive post-graduate institution and an incubator for startups are also planned.

Russia’s patriarchal nature — where the state takes care of things — is surprisingly ingrained. “Russians want a czar,” said Leonid Gozman, board member of the Russian government investment group Rusnano, explaining one line of Russian outlook. “They found their czar in Putin, and they love him.” Russia remains a mild dictatorship. It’s often explained this way: Russia’s unwieldy size, and its descent into instability whenever central power falters, has left many Russians craving strong leaders. A majority of Russians listed Stalin as the “greatest leader” in Russian history in a mass survey conducted in 2005.

And yet, most Russians I talked with said they don’t actually like Putin. One cab driver, when asked whether he supported Putin or not, told me he was too scared to talk about his views — apparently out of fear of reprisals. While Russians respect authority, they also fear it. The corrupt police force exacerbates this. On average, Russian police officers make less than $400 a month, which encourages them to take things into their own hands: One small-business owner I talked with said his greatest fear is of corrupt police pulling him aside, planting drugs in his car and demanding a pay-off of up to $2,000. This sort of thing is a regular occurrence. Here too, though, there’s relief on the way. The government, led by Medvedev, has pledged to triple police monthly salaries to $1,195 by the end of the year.

So where does this leave us?

Both economically and politically, the country has a long way to go.

On the economic front, Patricia Cloherty, CEO of Delta Private Equity Partners, one of the earliest U.S. investors in Russia, says there’s massive opportunity in modernizing Russia’s economy, but it’s all in traditional industries, not in high-tech startups. Her firm has pumped $500M in 55 companies since 1994, and there are signs of growth everywhere, she said. Russians bought 7 million cell phones in the first quarter of 2010 alone, up from 1995 when there were just 93,000 in existence. Hundreds of shopping malls have been built in Russia, up from just two in 1995. But she cautioned about investing in innovation, saying is should be “avoided.” Risks such as weak intellectual property laws are likely to stymie such projects. That’s why many U.S. tech investors continue to scour Russian universities to find technology for export to the U.S. for commercialization.

Politically, the consensus here is that Medvedev and Putin will push for progress … slowly. There’s broad confidence Russia is headed in the right direction, but everyone says it could take years. I had dinner with Yuri Milner of DST, the largest Russian investor in U.S. startups, and he took a pass when I asked him about plans to invest in Russia, and about Medvedev’s resolve to push forward reform (see video below). My own view is that it will take at least five years before things improve enough for U.S. venture funds to look at Russia seriously. And it can’t come until the state steps out of the way. If you listen to Medvedev, though, there’s no urgency to do that. He said he wants foreigners to understand Russia’s top-down approach: “That’s how our society has worked since the days of the patriarch. That’s not very good, but it’s a fact,” he told the group.

Disclosure: The trip was sponsored by Rusnano, and organized by the the American Business Association of Russian-Speaking Professionals (AmBar). I went to Russia with two hats: One as a writer for VentureBeat, the other as executive producer of DEMO, a conference for emerging technology startups. I’m trying to find the most dynamic companies in the world to have them launch in Silicon Valley at the conference this fall.

Hmm you notice many of important information. Due of this I am a weekly reader of your blog.

Thx

Okay article. I just became aware of your blog and desired to say I have really enjoyed reading your opinions. Any way I’ll be subscribing in your feed and Lets hope you post again soon.